2025 SECTION 179 BENEFITS:

Double Your Tax Savings This Year!

In your industry, precision drives profitability. The 2025 Section 179 deduction limit has doubled to $2.5 million, with 100% bonus depreciation on excess amounts. Invest in tools like 3D scanning, layout tools, GNSS, or drones to boost efficiency and slash taxes.

Why Act Now?

- Maximize Deductions: Write off up to $2.5M on qualifying equipment purchases, reducing your tax burden instantly.

- Supercharge Productivity: Upgrade to precision solutions that cut rework and delays, whether grading sites or mapping terrain.

- Year-End Deadline: Equipment must be purchased and in service by December 31, 2025.

What Qualifies?

New and Pre-Owned Equipment

Deduct 3D scanners, layout tools, GNSS, drones, and more. Tax deductions apply to more than just new equipment. We also have pre-owned solutions that qualify for the benefit, and they are certified, calibrated, and ready for action.

Software

Section 179 is highly beneficial for technology investments, including software, to support and grow your business. Invest in software subscriptions to streamline workflows and maximize ROI.

Bonus Depreciation

Apply 100% bonus depreciation to costs exceeding the $2.5M Section 179 cap.

Note: Deduction phases out for total equipment purchases over $4M.

How to Maximize Savings:

- Act Fast: Purchase and deploy equipment by year-end 2025.

- Bundle Investments: Combine hardware and software for bigger deductions.

- Use Financing: Preserve cash while claiming full tax savings.

- Keep Records: Save invoices and note service dates for your claim.

Leading contractors and surveyors are leveraging Section 179 to modernize their operations. Join them to gain a competitive edge.

Take Action!

Reach out to us. Use the form below, contact your CSDS account manager, or simply call (800) 243-1414 to explore tailored solutions. Act now to secure your 2025 tax savings!

Turn Your Next Equipment Purchase Into a Tax Advantage Before December 31, 2025!

If you need expert guidance on the type of precision equipment along with the necessary software to enhance your business operations, we are here to help. Connect with your CSDS representative or call (800) 243-1414.

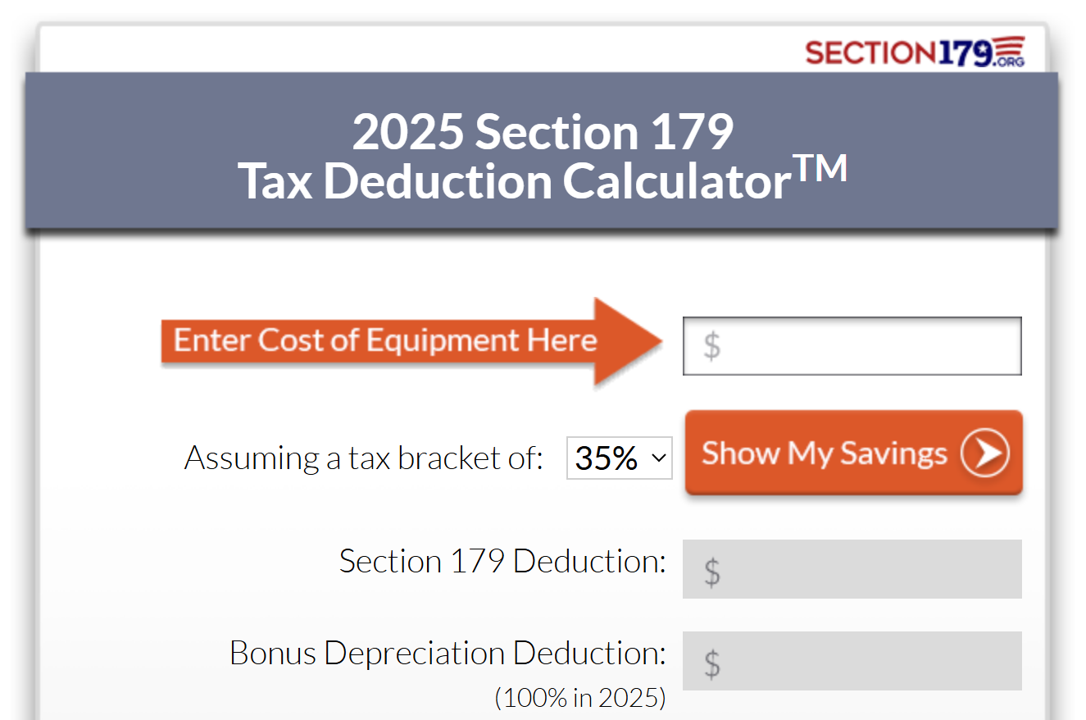

Use this online calculator to estimate your potential tax savings through Section 179. However, we always recommend consulting your accountant for the most accurate advice.